@article{roberson2022erl,

author={Roberson, Laura A. and Helveston, John Paul},

title={Not all subsidies are equal: Measuring preferences for electric vehicle financial incentives},

journal={Environmental Research Letters},

year={2022},

volume={17},

number={8},

pages={084003},

doi = {10.1088/1748-9326/ac7df3}

}Not all subsidies are equal: Measuring preferences for electric vehicle financial incentives

Roberson, Laura A. & Helveston, John P. (2022) “Not all subsidies are equal: Measuring preferences for electric vehicle financial incentives” Environmental Research Letters. 17(084003). DOI: 10.1088/1748-9326/ac7df3

Abstract:

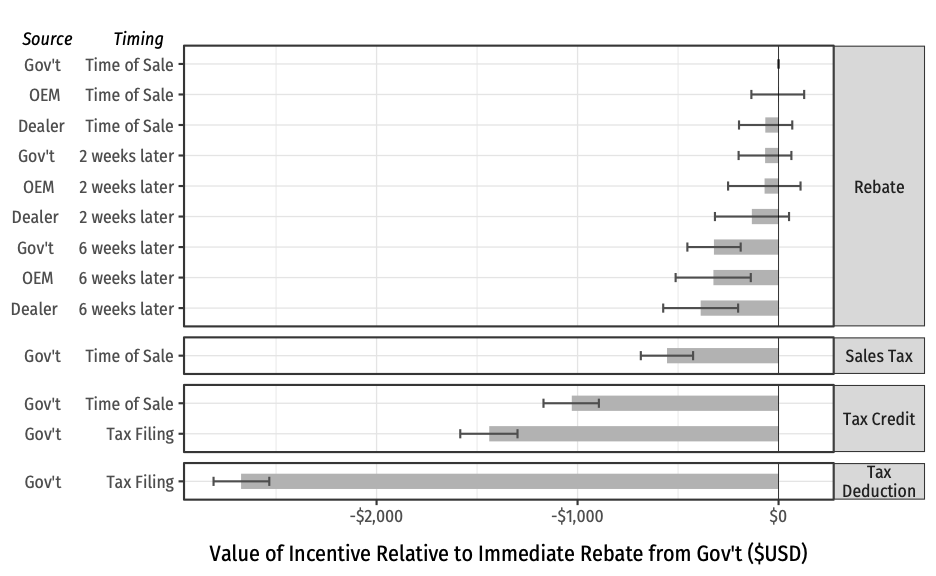

Financial incentives, such as purchase subsidies, have been found to increase plug-in electric vehicle (PEV) adoption, but how these incentives are designed can impact their effectiveness as well as how equitably they are distributed. Using a national conjoint survey (N = 2,170 respondents), we quantify how U.S. vehicle buyers value different features of PEV financial incentives. Participants overwhelmingly prefer immediate rebates, on average valuing them by $580, $1,450, and $2,630 more than sales tax exemptions, tax credits, or tax deductions, respectively. These effects are significantly larger for lower-income households, used vehicle buyers, and buyers with lower budgets. We estimate that on average $2 billion could have been saved if the federal subsidy available between 2011 and 2019 were delivered as an immediate rebate instead of a tax credit, or $1,440 per PEV sold. Our results suggest that structuring incentives as immediate rebates would deliver a greater value to customers and would be more equitably distributed compared to the current tax credit scheme.

Bibtex: